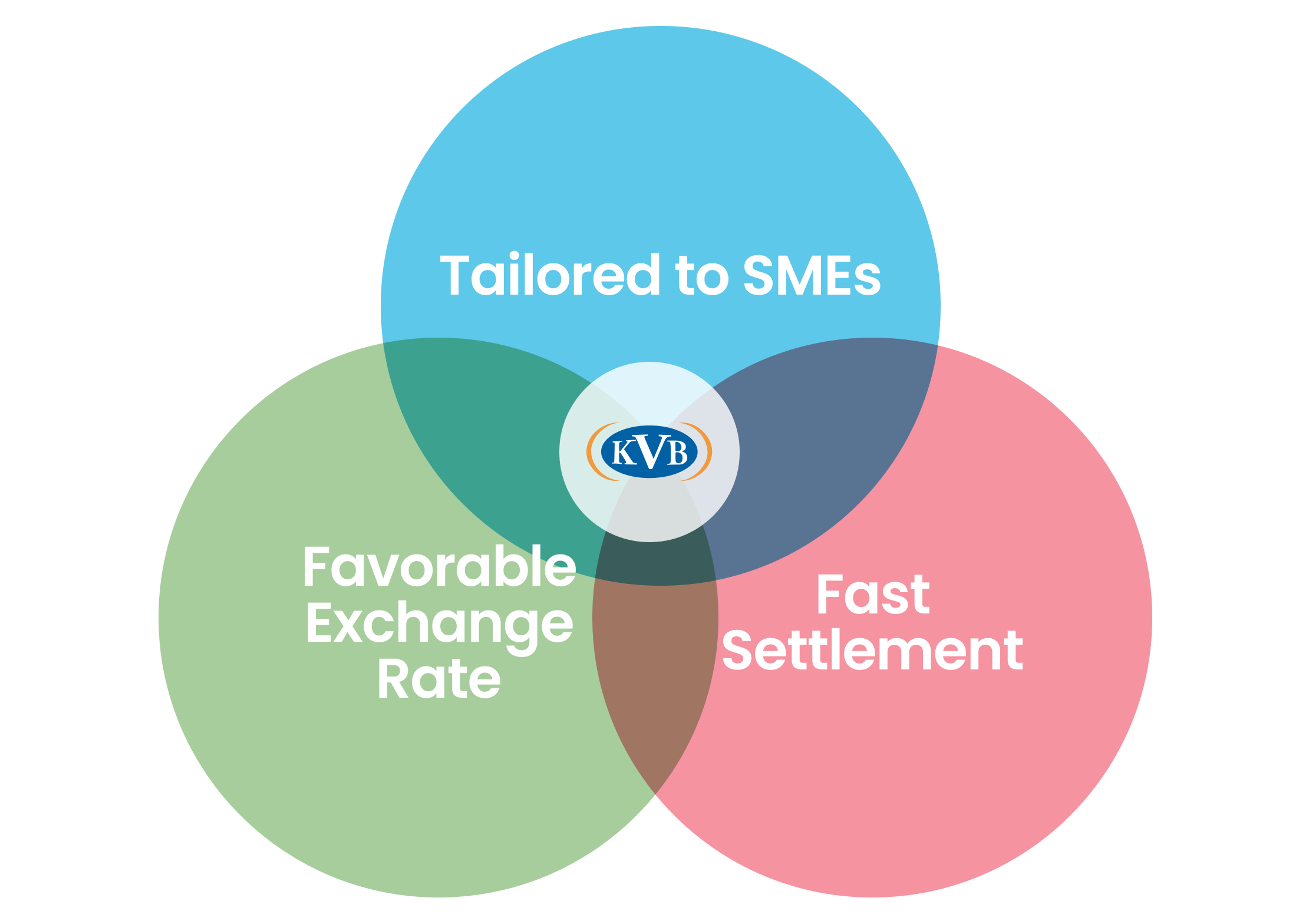

KVB cooperates with financial ecosystem partners to provide trade finance and remittance solutions for enterprises, increasing short-term cash flow and solving cross-border payment issues simultaneously. Businesses can focus on expansion easily.

Cash is the cornerstone of business operations. Companies always eager for cash flow to pay the supplier bills, logistics costs and marketing expenses. KVB collaborates with ecosystem partners to offer trade financing services and remittance services, helps SMEs and cross-border eCommerce companies to relieve the cash flow headaches and further reduce operation cost with FX forward instructions.

Company submits invoice or account receivable proofs to our trade finance partner

Company authorizes dedicated virtual accounts created in KVB as transaction accounts to collect financed capital, exchange currencies and make payments.

The dedicated accounts can collect accounts receivable from customers, repay the trade financed debts, exchange currencies and conduct cross-border transactions.

Helping companies to obtain cash quickly to relieve cash flow pressure, we ally with our supply chain finance partners provide trade finance services that are different from traditional banks. Companies can have invoice financing or accounts receivable financing applications.

No property collateral required

Online application

Speedy approval for a reasonable amount and interest

SMEs and cross-border eCommerce businesses are eligible

Having a virtual account in KVB enables you to fast collect worldwide payments in different currencies at ease like a local. In addition, companies can authorize dedicated account to accept approved loans and repay debts when having the trade finance services offered by our ecosystem partners.

Support HKD, CNH, JPY, SGD, GBP, AUD, NZD, USD, CAD, EUR

Virtual account with an identical name to your company

VIP exchange rates

Online application

Volatile FX markets adversely affect corporate profits or may even lead to losses. Leveraging KVB foreign exchange forward contracts, you can lock in advantageous rates for execution in specific future period to hedge against FX fluctuations.

Small deposit to lock in favorable rates

Enhance corporate risk hedging capability

Save foreign exchange cost

Improve cash flow management

We were struggling to find a reliable partner who can do cross-border payments that was predictable in timing, and offered good conditions for us in terms of exchange rates and service fees. We were very lucky to find you guys.

Veronika Sytina,

Director of United Sourcing Services Limited

KVB helps businesses from all walks of life, from business payout to overseas property investment. We provide competitive FX rates for our business clients in order to help their global settlement business.