KVB provides optimized corporate FX management solutions and consultation to assist corporate in controlling capital risks, easing the pressure on capital turnover, and resisting the foreign exchange risks.

KVB Global Capital Limited uses corporate foreign exchange management as its service foundation. With the help of continued investment into FinTech, it has created a one-stop foreign exchange management solution for its global customers. Our aim is to assist companies with hedging need to reduce their account exposures and to increase efficiency in its cash flow management.

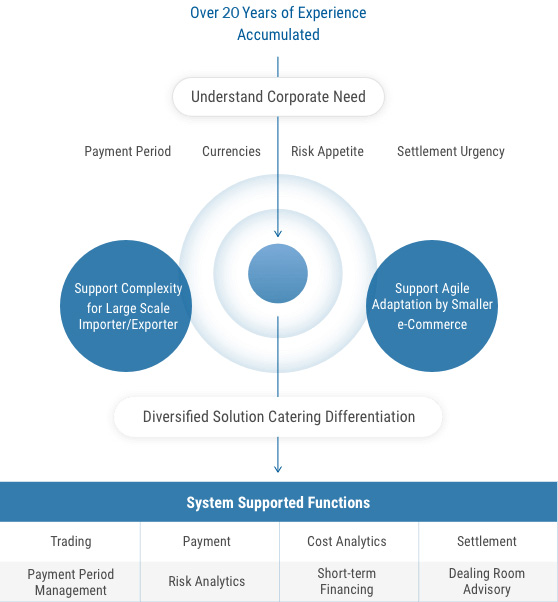

We have continuously helped our commercial customers to avoid market risks to the best extent possible for over 20 years. Meanwhile, we have accumulated valuable working experience and developed practical models for different business segments, including evaluation on different payment period, currencies involved, risk appetite, as well as settlement urgency. CorpVision, our analytics engine has assisted customers to dissect their risk exposure and to provide hedging strategies.

CorpVision is an analytics engine/platform that manages physical orders and their related foreign exchange risks. It offers ERP integration so that orders of physical products can be automatically converted to foreign exchange exposures. Its embedded logics will also provide recommendation based on order currency and proposed delivery schedule.

In this process we keep a close track of mark-to-market costs. Once a foreign exchange action is executed to fulfill a payment request, we will put a cost tag to that delivery bundle so we can evaluate the indicative profit and loss. Our commercial customer will enjoy the convenience of determining future pricing of that product based on actual costs taking account into foreign exchange, not just by face value.

Our risk analytics models are more practical coming from a wide range of angle. Comparing with market offerings of often singular methodology, we excel in comprehensiveness and accuracy based on our in-house capacity as foreign exchange prime broker. Our analytics model derives from seasonality, long term trends and short term market movement prediction. We apply/adjust compounded weights to those factors to increase accuracy of our model.

We have noticed most commerce related companies seldom care for impacts arising from foreign exchange fluctuation. However, events like Swiss Francs in 2015, Brexit in 2016, and U.S. election in 2017, all demonstrated that risk hedging using educated tools can prevent loss to certain extent. We believe it is critical for commercial customers to start managing their foreign exchange risks. From our observation of the industry for the past 30 years or so, those who concentrate on protecting profit as much as expanding their business growth eventually prevail in their respective market.

We have seen importers/exporters facing evolved market competition due to rapid changing economy and technology. Challenges from traditional product-chain and sales-chain are becoming even fiercer, but core risks from funding, payment as well as foreign exchange management are taking heavier tolls to companies as well. We know your pain points and this is why we take pride to offer you our advanced corporate FX advisory service.

No matter you are a MNE or a bilateral commerce company, our advisory service will assist you in finding any shortcuts in turning your cash flow faster by adopting KVB’s global trading and settlement service. Our competitive wholesale pricing will reduce your foreign exchange cost as well as increase profit margins. We have serviced thousands of commercial customers over the past 20 years and continue to expand our radar to more countries and regions.

Electronic trading and FX management platform for corporations

Key modules including FX Trading, Counterparty Price Pooling, Dealing Book Analytics, Settlement Approval, Nostro/Vostro Capacity, SWIFT Integration, Accounting Ledgers, Risk Analytics, Revaluation, and Prime Broker Module. We are also a truly reliable global liquidity provider for your international currency settlement and payment need.

Module implementation that caters your phased-requirement to avoid big bang hassle.

Provide system security advisory service and implementation assistance.

Sophisticated System Architect

Advanced FinTech Capacity

Experienced Business Analysts

Elite Business Consultants

Reduced impacts from foreign exchange rate fluctuations to your business

Reduced impacts to unexpected and adverse future market events

Enhanced cash flow utilization and turnaround speed

Spot Contract

Forward Contract

Swap Contract

Non-deliverable Forward Contract (NDF)

The Company started its operation in 2005 and acquired KVB’s service a year later. Since the intrinsic value of each cargo shipment was quite substantial, any adverse movement in exchange rate could result in huge and unbearable loss to the Company. The question of how to control this seemingly uncontrollable factor had become the Company’s key concern.

Over the past 10 years, the Company’s directors have been communicating with KVB’s relationship managers almost on a daily basis. Apart from gathering firsthand information on how market moves the directors also share with KVB their business requirement pertaining to each shipment. Together they formed customized risk hedging strategies using a combination of outright contracts with long term derivatives. This combination of both adequate product selection and personal advisory by truly understanding customer’s business has enabled the Company to an organic growth which ultimately brings it to the largest marine importers in Melbourne.

Together with the Company’s dedication to this business and KVB’s professional assistance, the Company has soon acquired the biggest percentage of the market share in Melbourne. KVB shall continue to assist the Company to a sustained future growth.

Commercial customers are exposed to different foreign exchange risks and they may, subsequently, result in profit being diluted heavily due to adverse rate movement. Locking down your cost and tackling your exchange rate risks will increase your operational efficiency as well as increase your profit margin.

Our leveraged forward contract will assist our commercial customers with hedging requirement up to 20 times of leverage ratio. This reduces margin funding pressure by as much as four times offered by traditional products.

Our offshore CNY leveraged products offers trading convenience for international enterprises for hedging their overseas income.

Our trading limit is 50,000 (50K) USD or equivalent currencies. We support non-traditional trading lots to two decimal places.

Our base currency is in USD and margin ratio is also calculated in USD.

We are licensed by Australia ASIC by only allowing deposits to our segregated fund account. Our system is encrypted and firewall-enabled to ensure the security of your trading and funds.

Please note: the above figures are represented in basis points. Major currency spreads and overnight swap points are for reference only. Figures may be adjusted up or down accordingly to the change of market conditions. Such change may include but not limited to reduced liquidity, market sentiment, as well as risk calculation.

Our trading platform — GCFX is easy to use. We offer advanced chart options and detailed daily reports, which shall be sent to your designated email address on a daily basis. We offer complete and real-time access to your trading accounts. You can place take-profit or stop-loss orders to better control your trading expectation.

You may choose to deposit your margin by electronic bank transfer. When such transfer is completed, please send over the transfer slip to KVB customer service representative for reconciliation.

After we confirm the funds are cleared, we will deposit the balance to your account. You will also receive an immediate notice from trading system about the deposit.

If you find any discrepancy in the deposit amount, please contact our customer service representative immediately.

If you would like to withdraw your deposited balance from KVB, you can perform the process on our online GCFX platform directly or contact your sales representative for assistance.

Please note if your request is submitted passing the cut-off time of our servicing banks, we will handle your request the earliest possible on the next business day.

KVB helps businesses from all walks of life, from business payout to overseas property investment. We provide competitive FX rates for our business clients in order to help their global settlement business.